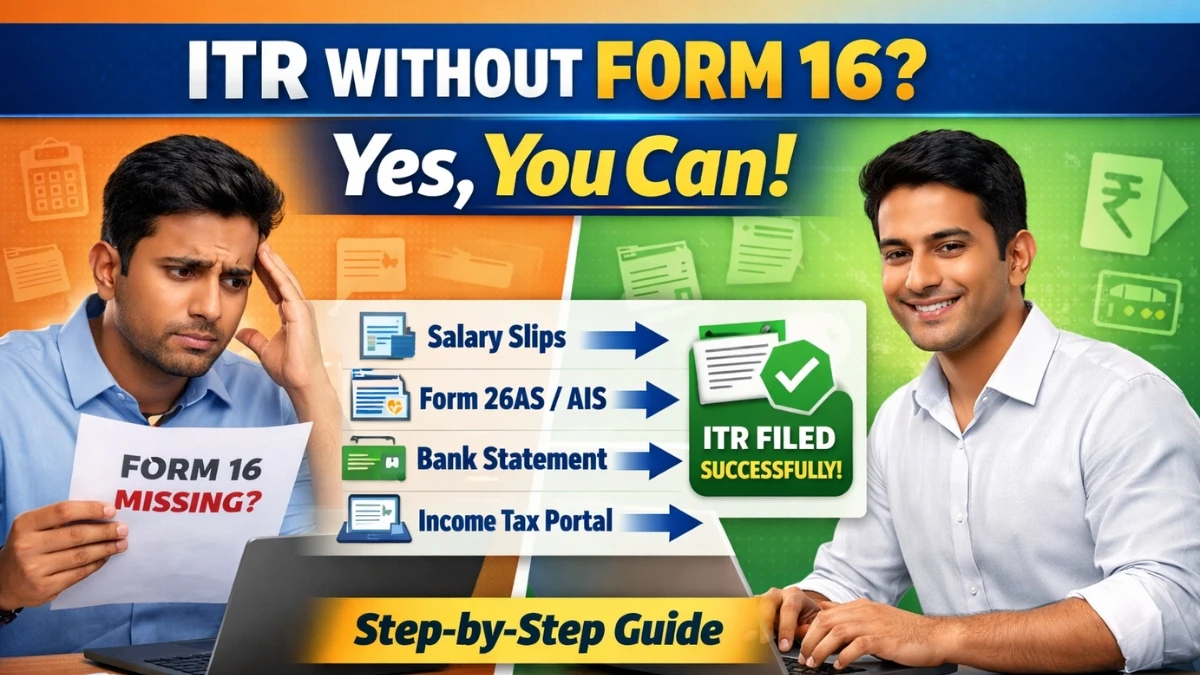

Can You File ITR Without Form 16 in India? Step-by-Step Guide for 2026

Yes, you can file ITR without Form 16 in India. Learn which documents to use, how to rely on Form 26AS, AIS, and salary slips, and file your return correctly in 2026.

by Alaguvelan M

Published Feb 18, 2026 | Updated Feb 18, 2026 | 📖 6 min read

Can You File ITR Without Form 16 in India? Complete Guide

Hey, if your employer hasn't handed over Form 16 yet, or maybe they never will because of a job switch, a small company issue, or just plain delay, don't panic. You're not stuck. Plenty of people in India file their Income Tax Return (ITR) every year without this document, and it's completely legal as long as you report everything accurately.

The short answer: Yes, you can file ITR without Form 16. Form 16 is basically a helpful summary from your employer showing your salary and the tax deducted at source (TDS), but it's not a must-have for filing.

The Income Tax Department cares about correct income reporting, proper TDS credit, and the right tax calculation, not whether you have that one piece of paper.

Especially now in 2026, with the new Income-tax Act changes kicking in from April 1 (like Form 16 becoming Form 130 and Form 26AS turning into Form 168 for future years), the focus is even more on digital records like AIS and 26AS.

But for most people filing for the current year, the old names still apply, depending on the assessment year. Let's walk through what Form 16 actually is, why you might not have it, and how to handle your filing smoothly.

What Is Form 16?

Form 16 is a TDS certificate that your employer issues under Section 203 of the Income Tax Act. It's proof that they've deducted tax from your salary and deposited it with the government. Think of it as your annual salary tax summary.

It comes in two parts:

- Part A — Covers the quarterly TDS details, your employer's TAN/PAN, your PAN, and how much tax was deducted and paid. This part is usually downloaded from the TRACES portal by the employer.

- Part B — Breaks down your total salary components (basic pay, allowances, bonuses), exemptions (like HRA), deductions claimed (80C investments, etc.), and the final taxable income and tax liability.

Employers are supposed to issue it by June 15 for the previous financial year, but delays happen, especially with startups, foreign employers, or non-compliant companies. It's super useful for quick ITR filing because it pre-fills a lot of numbers, but missing it doesn't stop you from filing.

Is Form 16 Mandatory for Filing ITR?

No, it's not mandatory. The Income Tax Act doesn't require you to attach or submit Form 16 with your return. What matters is that your reported income matches reality, TDS credits are claimed correctly (via 26AS/AIS), and you have supporting proofs if the department ever asks during scrutiny.

You're responsible for accurate reporting; Form 16 just makes it easier.

Is It Legal to File ITR Without Form 16?

Absolutely legal. As long as you use reliable alternatives to calculate your salary, deductions, and TDS, and you don't under-report income or over-claim credits, you're good. Thousands do this every season without issues.

Common Situations Where You May Not Have Form 16

- Your employer delayed issuing it (or forgot entirely).

- You switched jobs mid-year and only got Form 16 from one employer.

- You worked for a small/startup company that doesn't deduct or deposit TDS properly.

- Freelance/consultancy income (no salary TDS certificate at all).

- Foreign employer or non-compliant setup.

In all these cases, you can still file using other proofs.

Documents Required to File ITR Without Form 16

Gather these instead; they'll help you reconstruct everything:

- Monthly/annual salary slips from all employers (shows gross pay, allowances, deductions).

- Form 26AS (now transitioning to Form 168 post-April 2026, but still 26AS for current filings), download from the e-filing portal or TRACES; it lists all TDS credited to your PAN.

- Annual Information Statement (AIS) and Taxpayer Information Summary (TIS), Auto-populated on the portal; shows reported income, TDS, and high-value transactions.

- Bank statements (for interest income, credits, and verifying salary deposits).

- Investment/deduction proofs: PPF receipts, ELSS statements, health insurance premiums (80D), home loan interest certificate, rent receipts (for HRA), etc.

- Other income docs: FD interest certificates, mutual fund statements, capital gains reports, and rental agreements.

Cross-check everything against AIS to avoid mismatches.

Step-by-Step Guide: How to File ITR Without Form 16

Here's a practical walkthrough:

- Collect All Income Documents

- Grab salary slips for the full year from every employer, plus bank statements and other income proofs.

- Download Form 26AS, AIS, and TIS

- Log into the Income Tax e-filing portal → Go to 'e-File' > 'Income Tax Returns' > View Form 26AS/AIS. Verify TDS entries match what you expect.

- Compute Your Gross Salary Manually

- Add up basic pay, HRA, special allowances, and bonuses from slips. Subtract exempt parts (HRA if you have rent receipts, LTA if claimed).

- Add Income from Other Sources

- Include savings/FD interest, dividends, rental income, capital gains, pull from bank certs or AIS.

- Claim Deductions and Exemptions

- List 80C (up to ₹1.5 lakh), 80D, 80E, home loan interest under 24(b), etc. Keep proofs ready.

- Calculate Taxable Income and Tax Liability

- Apply old or new regime slabs, add surcharge/cess if applicable, claim rebate u/s 87A if eligible.

- Adjust TDS and Pay Balance Tax

- Use TDS from 26AS/AIS. If short, pay self-assessment tax via Challan 280 online. If in excess, claim a refund.

- Choose the Correct ITR Form and File Online

- Usually, ITR-1 (simple salary) or ITR-2 (multiple employers/other income). Fill details, validate, submit, and e-verify (Aadhaar OTP is easiest).

Important Points and Common Mistakes to Avoid

- Don't ignore AIS mismatches; report actual income even if not in AIS.

- Include all employers after a job change.

- Don't skip small interest income; it shows up in AIS.

- Keep deduction proofs for at least 6 years.

- File on time to avoid late fees.

What If There Is a Mismatch Between Salary Slips and Form 26AS/AIS?

TDS credit is based on what was actually deposited (per 26AS/AIS), not just your slip. If your employer deducted but didn't deposit, claim only what's in 26AS and pay the balance tax yourself. Ask your employer to correct their TDS return (Form 24Q) for future credit.

Deadlines, Penalties, and Late Filing Rules

For most individuals (non-audit cases), the due date is usually July 31 of the assessment year. For FY 2025-26 (AY 2026-27), it's 31 July 2026 for ITR-1/ITR-2. Late filing attracts a fee under Section 234F (up to ₹5,000 or ₹1,000) and interest under 234A/B/C.

File a belated return by December 31 if you miss the deadline, but penalties apply.

Disclaimer:

The information provided in this article is for general educational and informational purposes only and should not be considered tax, legal, or financial advice. Income tax rules, filing procedures, forms, and deadlines may change based on updates issued by the Income Tax Department of India. Readers are advised to verify details on the official Income Tax e-filing portal or consult a qualified tax professional before filing their Income Tax Return. Examples used in this article are illustrative and may not reflect individual tax situations.

Can You File ITR Without Form 16 in India - FAQ's

1. Can I file ITR without Form 16?

Yes, you can file ITR without Form 16 by using salary slips, Form 26AS, AIS, bank statements, and other income documents to calculate your income and tax liability.

2. Which documents are needed to file ITR without Form 16?

Salary slips, Form 26AS, AIS/TIS, bank statements, and investment proofs such as 80C or 80D documents are commonly required.

3. Is it legal to file ITR without Form 16?

Yes, it is completely legal as long as you accurately report your income, claim correct TDS credits, and pay any remaining tax.

4. What happens if the TDS in the salary slips does not match the Form 26AS?

You should rely on Form 26AS or AIS for TDS credit and contact your employer to correct discrepancies if tax was deducted but not deposited.

5. What is the due date to file ITR for FY 2025–26?

For most individuals (non-audit cases), the due date is typically 31 July of the assessment year, unless extended by the government.