SBI Mortgage Loan Interest Rate, Required Documents, Eligibility, and More

570 days ago

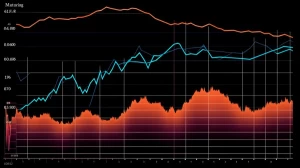

SBI mortgage loan interest rates vary based on loan amount and income type, starting from 1.45% plus 1-year MCLR for salary income and 2.10% plus 1-year MCLR for business o....