What Is the 50/30/20 Rule? Simple Budget Method Everyone’s Using in 2026

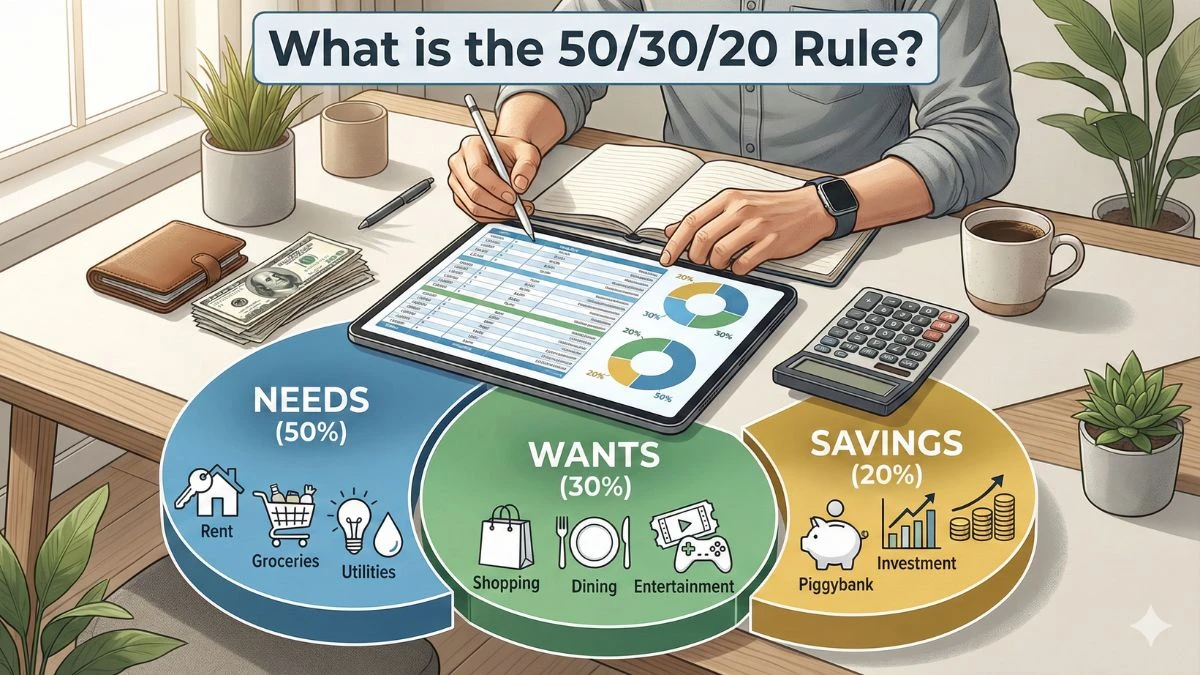

The 50/30/20 rule is a budgeting method that splits your after-tax income into 50% needs, 30% wants, and 20% savings or debt repayment. See how it works with examples.

by James

Published Feb 18, 2026 | Updated Feb 18, 2026 | 📖 4 min read

What is the 50/30/20 Rule?

The 50/30/20 rule is a simple budgeting method that suggests using 50% of after‑tax income for needs, 30% for wants, and 20% for savings and debt repayment.

It is less of a strict law and more of a friendly guideline that stops money from disappearing without anyone knowing where it went. The idea is to give a quick mental framework: rent and bills in one bucket, lifestyle fun in another, and future goals in the last.

Many modern banks and fintechs now explain this rule in plain language because people are tired of complicated budget templates and spreadsheets that are abandoned after week two.

The structure feels especially helpful for salaried people who just want one clear formula to start gaining control over monthly spending, without turning personal finance into a full‑time hobby.

Where did the 50/30/20 Rule Come From?

The 50/30/20 rule became popular after U.S. Senator Elizabeth Warren described it in the book “All Your Worth: The Ultimate Lifetime Money Plan,” co‑written with Amelia Warren Tyagi. The core message in that book was that money planning can be made easier by splitting after‑tax income into three broad categories instead of tracking every last rupee or dollar.

Over time, this simple structure has been adopted by banks, financial educators, and money apps around the world because it is easy to remember and easy to teach.

Some experts support it fully, while others tweak the percentages based on age, city, or income level, but the basic 50‑30‑20 framework still shows up in most beginner budgeting guides today.

How Does the 50/30/20 Rule Work in Everyday Life?

The 50/30/20 rule works by categorising every monthly expense into “needs,” “wants,” or “savings and debt,” then trying to keep each bucket close to its suggested percentage of income.

Needs usually include rent or home loan EMIs, groceries, basic utilities, essential transport, health insurance, and minimum debt payments. Wants cover eating out, shopping, OTT subscriptions, weekend trips, gadgets and all those “nice, but not absolutely necessary” spends.

The final 20% ideally goes into an emergency fund, retirement investing, goal‑based savings, or paying down high‑interest loans faster. A common real‑world pattern is that “needs” quietly creep above 50% in big cities due to rent and EMIs, so financial planners suggest adjusting gradually rather than feeling guilty and quitting the rule altogether.

In practice, many people start by just tracking one typical month using this lens, then slowly nudge numbers closer to 50/30/20 over a few months instead of trying to become “perfect” from day one.

Is the 50/30/20 Rule Realistic in 2026?

The 50/30/20 rule is realistic as a starting framework, but it often needs customisation in today’s high‑cost environment with rising rents, education fees and EMIs. Several financial educators now call it a “guiding ratio” rather than a fixed benchmark, especially in countries where essentials alone can cross 60% of income for middle‑class households.

Some updated versions suggest 50/20/30 or even 60/20/20 for young professionals who want to push more toward savings and investments once basic lifestyle is stable.

Others point out that for people with heavy existing debt, the “20%” bucket may temporarily be tilted more toward loan repayment first, then gradually shifted to investments after high‑interest balances are under control.

When Does the 50/30/20 Rule Help the Most?

The 50/30/20 rule helps most when someone feels overwhelmed by expenses and just needs a clear, non‑technical way to organise money. It tends to be especially useful for:

- fresh graduates and first‑job earners learning basic budgeting;

- salaried individuals wanting a quick system to balance lifestyle and savings;

- families trying to make sure long‑term goals are not ignored while managing daily bills.

Financial institutions and education platforms emphasise that the real strength of this rule is not mathematical perfection, but the habit of consciously separating needs, wants, and future‑focused money every month.

Once that habit builds, people often feel more in control, even if their personal version of the rule ends up looking more like 55/25/20 or 60/20/20 than the original textbook ratio.

Disclaimer:

This article is meant for general information and education only, not as professional financial, tax, or investment advice. Money situations differ from person to person, so always review your own numbers and, if needed, consult a qualified advisor before making budgeting or investment decisions.

What is the 50/30/20 Rule - FAQ's

1. What is the 50/30/20 rule in budgeting?

The 50/30/20 rule is a simple budgeting method where 50% of your after-tax income goes to needs, 30% to wants, and 20% to savings and debt repayment.

2. How do you calculate the 50/30/20 rule from salary?

Take your monthly in-hand (after-tax) income, multiply it by 0.50 for needs, 0.30 for wants, and 0.20 for savings or debt. These three amounts become your rough monthly budget limits.

3. What counts as “needs” in the 50/30/20 rule?

“Needs” usually include house rent or EMIs, basic groceries, utility bills, essential transport, school fees, insurance premiums, and minimum payments on existing loans.

4. Is the 50/30/20 rule realistic for low or middle income?

The rule is a guideline, not a strict rule. For many low or middle-income households, needs may cross 50%, so the ratios can be adjusted to something like 60/20/20 or 55/25/20 based on real-life expenses.

5. Can the 50/30/20 rule be changed for aggressive saving?

Yes, the percentages can be tweaked. People focused on early retirement or big goals (like buying a house) often shift to a higher saving ratio, such as 50/20/30 or even 40/20/40, depending on lifestyle flexibility.