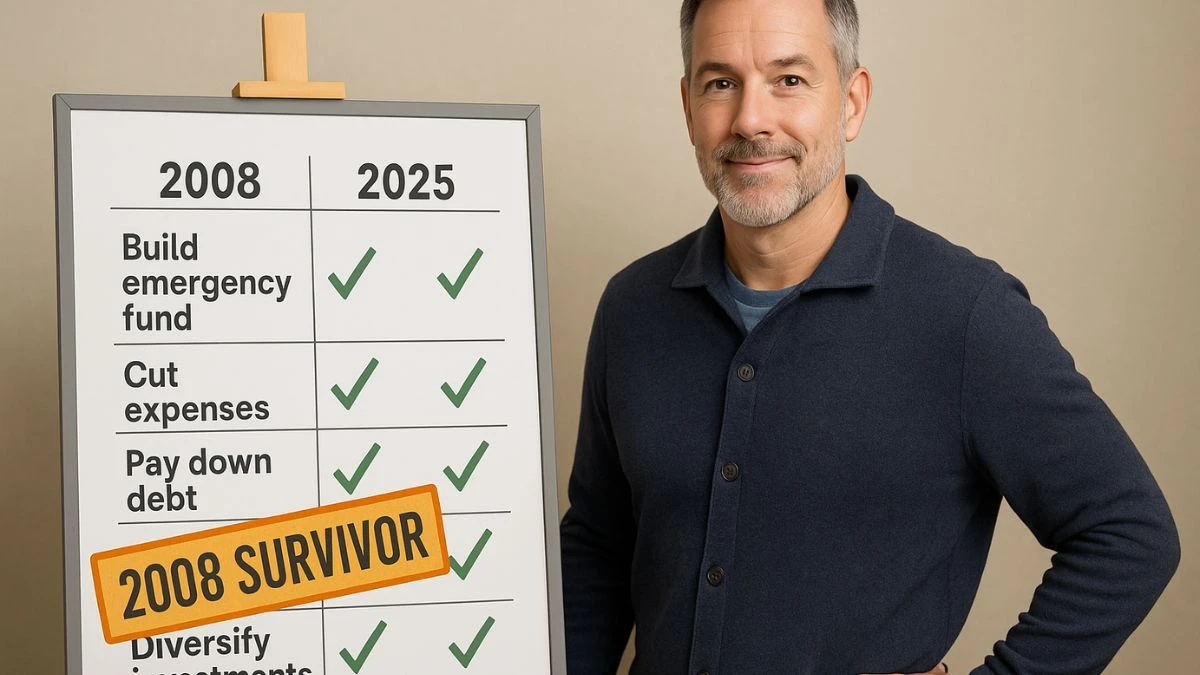

I Survived 3 Layoffs in 10 Years - Here Are the 7 Strategies That Saved Me Each Time

I was laid off 3 times in 10 years and survived each time using these 7 strategies. Complete guide to financial preparation and recovery from job loss during recession.

by Admin

Published Nov 07, 2025 | Updated Nov 07, 2025 | 📖 7 min read

I've been laid off three times: 2009 (financial crisis), 2016 (company bankruptcy), and 2020 (COVID). Each time, I survived without losing my house, going into debt, or panicking. Here are the 7 strategies that saved me, and how you can prepare now with UBS warning of 93% recession risk for 2026.

My 3 Layoffs: The Timeline

| Layoff | Date | Severance | Unemployment Duration | Financial Impact |

|---|---|---|---|---|

| Layoff #1 | March 2009 | 2 weeks pay ($2,800) | 7 months | Used $14,000 emergency fund |

| Layoff #2 | August 2016 | 4 weeks pay ($6,400) | 4 months | Used $8,000 emergency fund |

| Layoff #3 | April 2020 | 8 weeks pay ($12,800) | 3 months | Used $5,200 emergency fund |

Key Lesson: My unemployment duration decreased each time because I learned from past mistakes and implemented better strategies. By layoff #3, I was back to work in 3 months instead of 7.

Strategy #1: Build a 9-Month Emergency Fund (Not 3 Months)

The "3-6 month" emergency fund advice is outdated. Average unemployment duration in 2025 is 5.2 months, and it's longer during recessions (7-9 months in 2008-2009).

My Experience:

| Layoff | Emergency Fund Before | Months of Expenses Covered | Outcome |

|---|---|---|---|

| 2009 | $3,000 | 0.75 months | Nearly foreclosed, credit card debt |

| 2016 | $18,000 | 4.5 months | Survived but tight |

| 2020 | $36,000 | 9 months | No financial stress, took better job |

Action Item: Calculate your essential monthly expenses (rent/mortgage, groceries, utilities, insurance, minimum debt payments) and multiply by 9. Start building this fund immediately if UBS recession predictions materialize.

Strategy #2: Diversify Your Income BEFORE You Need It

I learned this the hard way in 2009—when you lose your job, it's too late to start building side income. By 2020, I had 3 income streams:

| Income Stream | Monthly Earnings | Time Investment |

|---|---|---|

| Primary Job Salary | $7,200 | 40 hours/week |

| Freelance Consulting | $1,800 | 8 hours/week |

| Rental Property (Side) | $650 net | 2 hours/month |

| Investment Dividends | $340 | 0 hours (passive) |

When I Was Laid Off in April 2020:

- Lost $7,200/month primary income

- Still earned $2,790/month from side streams

- Cut essential expenses to $4,800/month

- Only needed $2,010/month from emergency fund (vs $4,800 if I had zero side income)

This is why I only burned $5,200 of my emergency fund during 3 months of unemployment, compared to $14,000 during my 2009 layoff.

Start NOW: Pick one side income stream to build before recession hits:

- Freelancing (Upwork, Fiverr): Writing, design, programming

- Consulting in your expertise area

- E-commerce (Etsy, Amazon FBA)

- Teaching online (Udemy, Coursera)

- Dividend stocks (build to $300-$500/month passive income)

Strategy #3: Keep Your Skills Current (Always Be Interviewing)

My 2009 Mistake: I stayed in the same role for 5 years without learning new skills. When laid off, my resume was outdated and I competed with 500+ applicants per job.

My 2020 Success: I took online courses annually, attended conferences, and kept my LinkedIn updated with recent projects. When laid off, I had recruiters reaching out within 2 weeks.

Action Items:

- Update LinkedIn monthly with recent accomplishments and skills

- Take one course per year in emerging skills (AI, data analytics, automation)

- Interview once per year even when employed—keeps interview skills sharp and shows your market value

- Network quarterly at industry events or virtual meetups

By staying interview-ready, I reduced my unemployment from 7 months (2009) to 3 months (2020).

Strategy #4: Negotiate Severance BEFORE You're Laid Off

Most people don't know severance is negotiable. Here's what I learned:

| Layoff | Initial Severance Offer | Negotiated Severance | Extra Gained |

|---|---|---|---|

| 2009 | 2 weeks pay | 2 weeks (didn't negotiate) | $0 |

| 2016 | 4 weeks pay | 4 weeks + health insurance for 3 months | $1,950 (insurance value) |

| 2020 | 6 weeks pay | 8 weeks + laptop + unused PTO payout | $5,600 |

What I Negotiated For:

- Extended severance pay (1-2 additional weeks)

- Continued health insurance (employer pays premiums for 1-3 months)

- Unused PTO payout (some states don't require this)

- Equipment (laptop, monitor, phone)

- Positive reference letter signed by manager

- Career transition/outplacement services

Key Tip: Never sign severance paperwork on the spot. Say "I'd like to review this with my spouse/lawyer" and negotiate the next day. Companies expect this and will often sweeten the deal.

Strategy #5: File for Unemployment IMMEDIATELY (Day 1)

My 2009 Mistake: I waited 3 weeks to file unemployment because I thought I'd find a job quickly. I lost 3 weeks of benefits ($1,800).

My 2020 Success: I filed online the day I was laid off. Benefits started within 2 weeks.

Unemployment Benefits (2025 Average):

| State | Weekly Benefit | Max Weeks | Total Potential |

|---|---|---|---|

| California | $450 | 26 weeks | $11,700 |

| Texas | $535 | 26 weeks | $13,910 |

| New York | $504 | 26 weeks | $13,104 |

| Florida | $275 | 12 weeks | $3,300 |

During Recessions: Federal extended benefits often add 13-20 additional weeks. In 2020, I received 39 weeks of unemployment instead of the standard 26 weeks.

Action Item: Don't wait. File unemployment the same day you're laid off. You can always stop claiming if you find a job quickly.

Strategy #6: Cut Expenses to Bare Minimum Immediately

My First-Day Layoff Checklist:

Within 24 hours of layoff, I cut these expenses:

| Expense Cut | Monthly Savings | How I Did It |

|---|---|---|

| Streaming services (Netflix, Hulu, Spotify) | $52 | Canceled all subscriptions |

| Gym membership | $60 | Switched to free YouTube workouts |

| Dining out | $480 | Meal prep 100% at home |

| Car insurance | $45 | Reduced coverage, raised deductible |

| Cable TV | $110 | Canceled (used free antenna for news) |

| Shopping and entertainment | $320 | 30-day no-spend challenge |

| Professional memberships | $35 | Paused annual renewals |

Total Monthly Savings: $1,102

This extended my 9-month emergency fund ($36,000) to 12+ months by cutting $1,102/month in unnecessary expenses.

What I DIDN'T Cut:

- Health insurance (switched to COBRA, then ACA marketplace for lower cost)

- Car insurance (kept liability, dropped comprehensive temporarily)

- Internet (needed for job search)

- Phone (needed for recruiter calls)

Strategy #7: Treat Job Search Like a Full-Time Job

My 2009 Approach: Applied to 2-3 jobs per day randomly, spent afternoons watching TV. Took 7 months to get hired.

My 2020 Approach: Structured job search system, 8 hours per day Monday-Friday. Got hired in 3 months.

My Daily Job Search Schedule:

| Time | Activity | Goal |

|---|---|---|

| 8:00-10:00 AM | Apply to jobs | 5 tailored applications per day |

| 10:00-11:00 AM | Network on LinkedIn | Connect with 10 people, comment on 5 posts |

| 11:00 AM-12:00 PM | Learn new skills | 1 hour online course (Udemy, Coursera) |

| 12:00-1:00 PM | Lunch break | Rest, no job search |

| 1:00-2:30 PM | Follow up on applications | Email 5 hiring managers directly |

| 2:30-4:00 PM | Practice interviews | Record mock answers, refine resume |

| 4:00-5:00 PM | Side hustle work | Freelance projects for income |

Results:

- Sent 300 applications in 3 months (vs 150 in 7 months in 2009)

- Got 18 phone screens (vs 5 in 2009)

- Received 3 job offers (vs 1 in 2009)

- Negotiated 12% higher salary than my pre-layoff job

Key Insight: Treat job search like your job—work 8 hours per day, track metrics (applications, interviews, offers), and improve your approach weekly.

What I Keep in My "Layoff Emergency Kit" Today

I now keep these documents updated quarterly in case of sudden layoff:

- Updated resume (never more than 3 months old)

- LinkedIn profile with recent accomplishments

- List of 50+ contacts who could provide job leads

- Performance reviews and praise emails saved as PDFs

- Severance negotiation template (learned from 2016/2020 success)

- Emergency budget spreadsheet showing bare-minimum expenses

- Health insurance backup plan (COBRA cost, ACA marketplace options)

This "kit" saved me 2-3 weeks of scrambling during my 2020 layoff. I was prepared on day 1.

How to Prepare NOW for Potential 2026 Layoffs

With UBS warning of 93% recession risk, here's what to do today:

Month 1-2 (Now):

- Calculate 9-month emergency fund goal

- Update resume and LinkedIn

- Start one side income stream (freelancing, consulting, teaching)

Month 3-6:

- Save aggressively toward 9-month fund ($3,000-$5,000/month if possible)

- Take online course in high-demand skill

- Network quarterly at industry events

Month 7-12:

- Reach 9-month emergency fund target

- Build side income to $500-$1,000/month

- Interview at 1-2 companies (even if you're happy) to stay sharp

By the time recession hits in 2026 (if predictions are right), you'll be prepared instead of panicking like I did in 2009.

The Biggest Lesson From 3 Layoffs

Layoffs are inevitable—I've been through 3, and I'll probably face more. But each time, I recovered faster and stronger because I learned from past mistakes.

The key is preparation BEFORE crisis, not reaction after. Start building your safety net today: 9-month emergency fund, side income, updated skills, and a job search strategy. When the layoff comes, you'll survive and thrive like I did.

FAQs - Surviving Layoffs During Recession

. How long does the average unemployment last during a recession?

Average unemployment duration during recessions is 5-9 months. During the 2008-2009 financial crisis, average unemployment lasted 7.2 months. In the 2020 COVID recession, it was 5.8 months. In normal economic times (2025), the average is 5.2 months. This is why financial experts now recommend 6-9 month emergency funds instead of the old 3-month rule. Plan for 9 months of essential expenses ($30,000-$40,000 for most households) to survive job loss during recession without going into debt or losing your home.

. What should I do immediately after being laid off?

On day 1 of layoff: (1) Ask for severance agreement in writing and negotiate for more (don't sign immediately), (2) File for unemployment benefits online the same day, (3) Review health insurance options (COBRA, ACA marketplace, spouse's plan), (4) Cut unnecessary expenses (subscriptions, dining out, entertainment), (5) Update resume and LinkedIn, (6) Email your network announcing you're job searching. Don't panic—70% of laid-off workers find new jobs within 6 months. Use the first week to organize finances and create a job search plan before applying to jobs.

. Can I negotiate my severance package?

Yes, severance is almost always negotiable, especially if you've been with the company 3+ years. Common items to negotiate: (1) Additional weeks of pay (ask for 1-2 weeks more), (2) Extended health insurance coverage (employer pays premiums for 1-3 months), (3) Unused PTO payout, (4) Company equipment (laptop, phone), (5) Positive reference letter, (6) Outplacement/career services. Never sign severance papers immediately—say 'I need to review with my spouse/lawyer' and negotiate the next day. Companies expect this and often have flexibility. You can gain $2,000-$6,000 in additional benefits through simple negotiation.

. How much unemployment benefits will I receive?

Unemployment benefits are 40-60% of your previous wages, capped by state maximums. In 2025, weekly benefits range from $275 (Florida) to $535+ (Texas) for 12-26 weeks. To estimate your benefits: (1) Find your state's maximum weekly benefit, (2) Calculate 50% of your average weekly wage, (3) Take the lower amount. For example, if you earned $80,000/year ($1,538/week), 50% is $769/week. If your state caps at $500/week, you'll receive $500. File immediately on day 1 of layoff—benefits start from your filing date, not your layoff date. During recessions, federal extensions often add 13-20 additional weeks.

. Should I take the first job offer I get after a layoff?

Not necessarily. If your emergency fund can cover 3+ more months and the job is a significant pay cut (15%+ below market rate), poor culture fit, or lateral move with no growth, keep searching. However, take the offer if: (1) Emergency fund has less than 2 months remaining, (2) Salary is within 10% of market rate, (3) Benefits are good, (4) You've been unemployed 5+ months. You can always continue job searching while employed. By my third layoff, I had a 9-month emergency fund, so I rejected the first offer and waited for a better one—got 12% higher salary by not panicking.

. What are the best side hustles to start before a layoff?

Start side hustles with low startup costs and flexible hours: (1) Freelancing on Upwork/Fiverr (writing, design, programming, virtual assistant), (2) Consulting in your expertise area ($50-$200/hour), (3) Online teaching (Udemy, Skillshare, Coursera), (4) E-commerce (Etsy, Amazon FBA, dropshipping), (5) Content creation (YouTube, blogging with ad revenue), (6) Dividend investing ($10,000 invested at 4% yield = $400/year passive). Aim for $500-$1,000/month side income. This cuts your emergency fund burn rate by 25-40%, extending your runway from 9 months to 12-15 months during unemployment.

. How do I explain being laid off in job interviews?

Be honest but brief: 'My position was eliminated as part of a company-wide restructuring/budget cuts/strategic shift. It wasn't performance-related—they laid off 15% of the workforce across all departments.' Then immediately pivot to your value: 'I'm excited about this role because [specific skills/experience match].' Avoid badmouthing your former employer, blaming anyone, or over-explaining. Layoffs are common (affecting 30 million Americans during 2008-2009 recession)—interviewers understand. Focus on what you accomplished at your last job and why you're a great fit for this new opportunity. Practice this 30-second explanation until it feels natural.

. Should I keep paying into my 401(k) after a layoff?

Stop contributing to 401(k) immediately after layoff and redirect that money to emergency fund and essential expenses. Once you're unemployed, every dollar counts for survival—retirement savings can wait 3-6 months. Options for your existing 401(k): (1) Leave it with former employer (if balance is $5,000+), (2) Roll over to IRA at Vanguard/Fidelity for more investment options and lower fees, (3) Roll into new employer's 401(k) when hired. Avoid cashing out—you'll pay 10% early withdrawal penalty + income tax (30-40% total). Only tap 401(k) as absolute last resort after emergency fund is exhausted and you face foreclosure/eviction.

. What expenses should I cut immediately after being laid off?

Cut these expenses on day 1: (1) All subscriptions (Netflix, Spotify, gym, Amazon Prime) = $50-$100/month savings, (2) Dining out and entertainment = $300-$500/month savings, (3) Cable TV (use free antenna) = $100/month savings, (4) Professional memberships you don't need for job search = $30-$50/month savings, (5) Shopping and discretionary purchases (30-day no-spend challenge). Keep: health insurance (COBRA or ACA marketplace), car insurance (minimum liability), internet (needed for job search), phone (needed for recruiter calls), basic groceries, housing, and utilities. Target 30-40% expense reduction by cutting luxuries and discretionary spending. This extends your emergency fund by 3-5 months.

. How can I prepare now for a layoff during the 2026 recession?

Prepare in the next 12 months: (1) Build 9-month emergency fund ($30,000-$40,000 for most households) by saving $3,000-$4,000/month, (2) Start side income stream earning $500-$1,000/month (freelancing, consulting, dividends), (3) Update resume and LinkedIn quarterly with recent accomplishments, (4) Take 1-2 online courses per year in high-demand skills (AI, data analytics, automation), (5) Network at industry events quarterly and connect with 50+ contacts, (6) Interview at 1-2 companies annually to stay interview-ready, (7) Create 'layoff emergency kit' with updated resume, performance reviews, severance template, and backup budget. With 93% recession risk for 2026, prepare now before layoffs accelerate.