- Home »

- Quarterly Results »

- L&T Q4 Results

L&T Q4 Results

The L&T Q4 results were released after the board of directors meeting on may 8th and overall profit after tax is 4,396 crores which is a 10% growth compared with previous quarters

by Damodharan N

Published May 13, 2024 | Updated May 13, 2024 | 📖 3 min read

L&T

Larsen & Toubro (L&T) is a well-known Indian multinational company Headquartered in Mumbai, Maharashtra that specializes in Engineering, Procurement, and Construction (EPC) projects, Hi-Tech Manufacturing, and Services. With a presence in over 50 countries worldwide.

As the company operates across various segments like Infrastructure, Energy, Hi-Tech Manufacturing, IT & Technology Services, and Financial Services among others. The company had also bagged the contract for MAHSR high-speed train project in which the company is doing electrification for the segment Package No: EW 1 in the month of January 2024.

L&T Q4 Results

L&T released its Q4 results after the board of directors meeting that was held on May 8th from 1.00 pm to 5.00 pm. The company in its report stated that its revenue from the operations is 67,079 crores which is a 15% increase from the previous quarter. The consolidated profit after tax is 4,396 crores which is a 10% increase from Q4 2023.

The L&T chairman and managing director S.N. Subrahmanyan said about the overall financial report for FY23-24 in which he stated that order inflows for the financial year FY 23- 24 are ₹ 3 lakh crore.

The company has completed marquee projects in this quarter like Atal Setu and Coastal Road project in Mumbai and also played its part in finishing the Ayodhya Ram Mandir. He also said that as per the company's own L&T vision plan known as Lakshya 2026, the company is divesting from its non-core business and sold its stake in the L&T IDPL in this financial year.

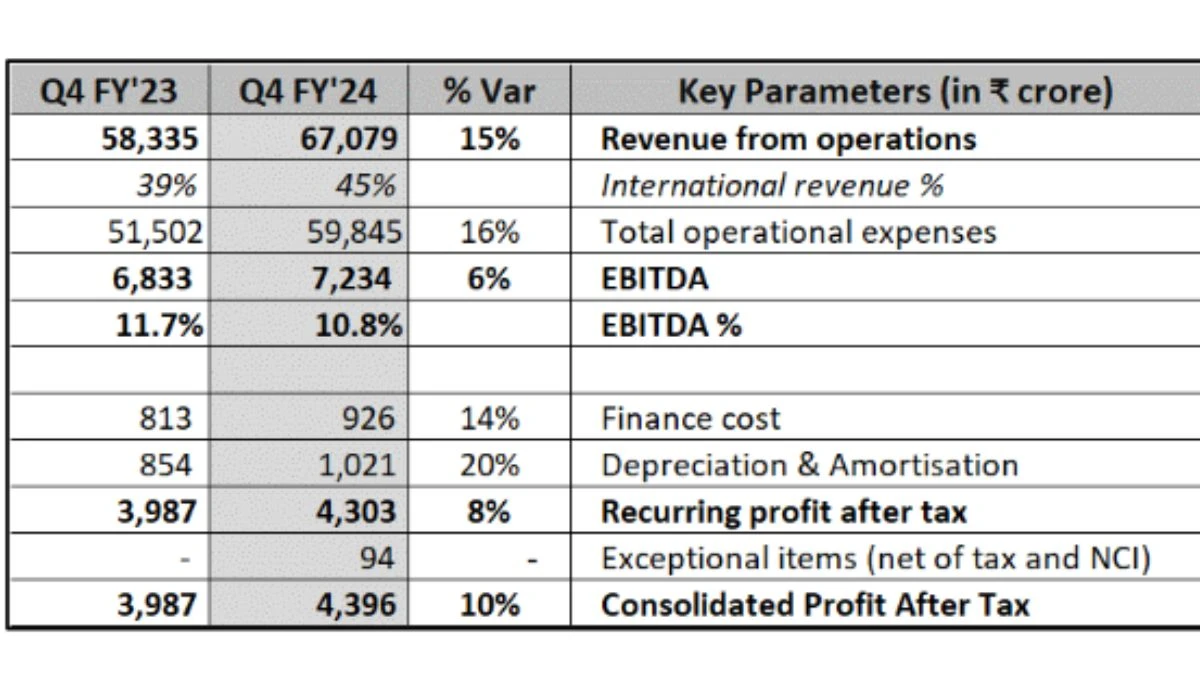

The figure for Q4 is as follows:

This table presents the key parameters for Q4 of financial years 2023 and 2024, along with the percentage variation (% Var) between the two periods.

L&T Q4 Highlights

The L&T Q4 segment-wise data for the Q4 are given

Infrastructure Projects Segment:

- Order inflow decreased by 24% compared to the same quarter last year.

- The order book stood at ₹311,665 crore as of March 31, 2024.

- Customer revenues grew by 22% year-on-year (YoY), with international revenues contributing 36%.

- The EBITDA margin for the segment was 6.2%.

Energy Projects Segment:

- Order inflow increased significantly by 48% compared to Q4 of the previous year.

- The order book was at ₹118,189 crore as of March 31, 2024, with 80% from international orders.

- Customer revenues grew by 4% YoY, with international revenues contributing 61%.

- The EBITDA margin improved to 10.0% compared to the previous year.

Hi-Tech Manufacturing Segment:

- Order inflow grew by 3% compared to the same quarter last year.

- The order book stood at ₹31,975 crore as of March 31, 2024, with 8% from export orders.

- Customer revenues increased by 15% YoY, with export sales comprising 25%.

- The EBITDA margin for the segment was 16.3%.

IT & Technology Services (IT&TS) Segment:

- Customer revenues increased by 3% YoY.

- International billing contributed 91% of the total customer revenues.

- The EBITDA margin remained largely unchanged at 20.4%.

Financial Services Segment:

- Income from operations grew by 15% YoY.

- The total loan book increased by 6% compared to the previous year.

- Retail loans constituted 94% of the total loan book.

- Profit before tax (PBT) increased to ₹3,028 crore.

Development Projects Segment:

- Customer revenues grew by 2% YoY.

- The segment EBIT reached ₹1,015 crore, primarily due to the gain on sale of commercial property.

"Others" Segment:

- Customer revenues increased by 27% YoY.

- Export sales constituted 12% of the total customer revenues.

- The EBITDA margin for the segment improved to 21.2%.

Larsen and Toubro's share price

The L&T share price when the stock market closed for the last working day was onMay 10th 3276.15 Rs.

|

Metric |

Value |

|

Previous Close |

3276.15 |

|

Open |

3284.60 |

|

High |

3305.80 |

|

Low |

3235.15 |

|

VWAP |

3,264.37 |

L&T Q4 Results - FAQs

1. What were L&T's Q4 results for FY24?

L&T's Q4 results for FY24 show that profit after tax: ₹4,396 crores 10% increase from Q4 FY23.

2. What is the dividend share that was announced?

The dividend share amount is Rs.28

3. When will the next AGM be held?

The AGM will be held on July 4, 2024.

4. What is the record date for the L&T dividend?

The record date for the L&T dividend is June 20, 2024.