- Home »

- Quarterly Results »

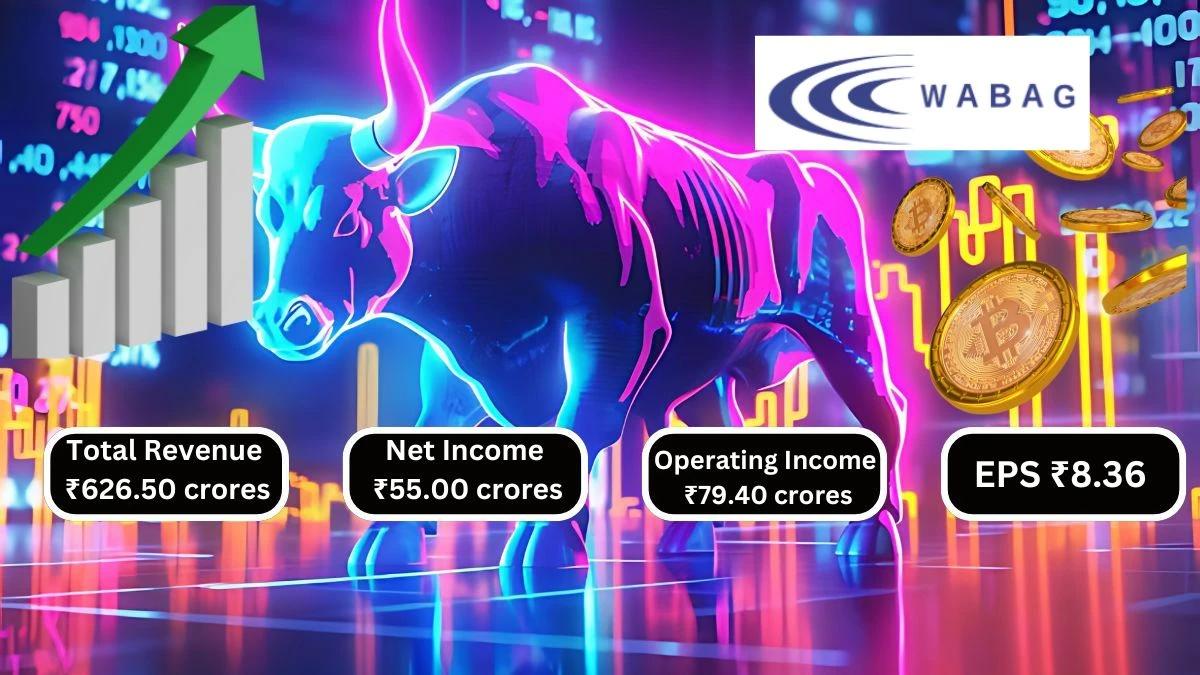

- Va Tech Wabag Q1 Results Total Revenue ₹626.50 crores & Net Income ₹55.00 crores

Va Tech Wabag Q1 Results Total Revenue ₹626.50 crores & Net Income ₹55.00 crores

Va Tech Wabag Q1 Results Reported Total Revenue of ₹626.50 crores, a 13.33% increase YoY from 552.80 crores and Net Income reached ₹55.00 crores, up 10.00% from last year.

by Ruksana

Updated Sep 23, 2024

Table of Content

Va Tech Wabag Quarterly Growth

Va Tech Wabag Q1 Results: Va Tech Wabag's Q1 results show some important changes in their financial performance. First, let’s look at the year-over-year (YoY) comparison. The total revenue for June 2024 was ₹626.50 crores, which is up 13.33% from ₹ 552.80 crores in June 2023. This YoY increase indicates the company is growing compared to last year. However, when we compare the current quarter to the previous quarter (QoQ), revenue decreased by 32.94% from ₹926.86 crores in March 2023. This shows a decline in performance quarter-on-quarter.

Va Tech Wabag’s net income earned ₹55.00 crores in June 2024, a 10.00% YoY increase from ₹50.00 crores last year. This YoY growth is a positive sign, even though net income dropped by 24.03% compared to the previous quarter, which was a loss of ₹111.10 crores. The operating income also reflects these trends, showing a 24.26% YoY rise but a 29.73% drop QoQ. Overall, while Va Tech Wabag shows YoY improvements in several areas, the QoQ comparisons reveal significant challenges that the company needs to address moving forward.

Here's the quarterly results for Va Tech Wabag for Q1 in table format:

(Values in Rs.)

|

Metric |

Jun 24 (Current) |

Mar 23 (Previous) |

QoQ Change |

Jun 23 (Last Year) |

YoY Change |

|

Total Revenue |

626.50 crores |

926.86 crores |

-32.94% |

552.80 crores |

+13.33% |

|

Selling/General/Admin Expenses |

59.80 crores |

69.35 crores |

-13.42% |

58.60 crores |

+2.05% |

|

Depreciation/Amortization |

1.90 crores |

2.15 crores |

-11.63% |

1.70 crores |

+11.76% |

|

Other Operating Expenses |

25.60 crores |

-26.49 crores |

-197.13% |

10.80 crores |

+137.04% |

|

Total Operating Expense |

547.10 crores |

1,055.22 crores |

-33.38% |

488.90 crores |

+11.90% |

|

Operating Income |

79.40 crores |

-128.36 crores |

-61.87% |

63.90 crores |

+24.26% |

|

Net Income Before Taxes |

70.00 crores |

-141.84 crores |

-49.26% |

64.00 crores |

+9.38% |

|

Net Income |

55.00 crores |

-111.10 crores |

-49.84% |

50.00 crores |

+10.00% |

|

Diluted Normalized EPS |

8.36 |

8.56 |

-2.33% |

7.84 |

+6.63% |

Source: Here

For More Q1 Results check our Twitter Page

Visit our website for more Q1 result

Va Tech Wabag Q1 Results

Va Tech Wabag earned ₹ 6,265 million in revenue from operations and had other income of 108 million, totaling ₹ 6,373 million in income for consolidated results. The expenses were ₹ 5,651 million, which includes costs for sales, employee salaries, and other operating costs. This means the profit before tax was 700 million, leading to a net profit of 548 million after accounting for taxes.

In Va Tech Wabag individual performance, the revenue from operations was ₹ 5,459 million, with total income of ₹ 5,477 million. The expenses in this section were lower at ₹ 4,815 million, resulting in a profit before tax of ₹ 662 million and a net profit of ₹ 505 million.

Va Tech Wabag’s Earnings per share, which shows how much profit each share earns, was ₹ 8.84 for consolidated and ₹ 8.12 for standalone results. Overall, the table indicates that VA Tech Wabag is maintaining a stable financial position, with good profits and manageable expenses.

Here’s the consolidated and standalone financial results of VA Tech Wabag presented in a table format:

(₹ in Millions)

|

Particulars |

Quarter Ended 30/06/2024 (Consolidated) |

Year Ended 31/03/2024 (Consolidated) |

Quarter Ended 30/06/2024 (Standalone) |

Year Ended 31/03/2024 (Standalone) |

|

Revenue from Operations |

6,265 |

28,564 |

5,459 |

25,097 |

|

Other Income |

108 |

434 |

18 |

313 |

|

Total Income |

6,373 |

28,998 |

5,477 |

25,410 |

|

Cost of Sales and Services |

4,634 |

21,672 |

4,001 |

19,295 |

|

Employee Benefits Expense |

598 |

2,354 |

446 |

1,729 |

|

Finance Cost |

180 |

711 |

140 |

594 |

|

Depreciation and Amortisation |

19 |

84 |

6 |

42 |

|

Other Expenses |

256 |

786 |

240 |

591 |

|

Total Expenses |

5,651 |

25,602 |

4,815 |

22,250 |

|

Profit Before Tax |

700 |

3,301 |

662 |

3,160 |

|

Profit for the Period |

548 |

2,504 |

505 |

2,358 |

|

Earnings Per Share (Basic) |

8.84 |

39.49 |

8.12 |

37.91 |

|

Earnings Per Share (Diluted) |

8.74 |

39.49 |

8.03 |

37.73 |

|

Total Comprehensive Income |

529 |

2,510 |

502 |

2,346 |

Va Tech Wabag Stock Performance

Va Tech Wabag is a company with a market capitalization of ₹9,251 crores, which shows its overall value in the stock market. The current stock price is ₹1,488, with a high of ₹1,564 and a low of ₹435 over a certain period. The stock has a Price-to-Earnings (P/E) ratio of 37.0, indicating how much investors are willing to pay for each unit of earnings. The book value is ₹292, meaning this is the value per share based on the company's assets.

Here's a simple summary of the market data you provided:

|

Market Data |

Value |

|

Market Cap |

₹ 9,251 Cr. |

|

Current Price |

₹ 1,488 |

|

High / Low |

₹ 1,564 / ₹ 435 |

|

Stock P/E |

37.0 |

|

Book Value |

₹ 292 |

|

Dividend Yield |

0.00 % |

|

ROCE |

19.8 % |

|

ROE |

13.8 % |

|

Face Value |

₹ 2.00 |

Quarterly Results

The table presents the quarterly financial results for Va Tech Wabag, showing figures in crores of rupees. It includes key metrics like sales, expenses, operating profit, and net profit for December 2023, March 2024, and June 2024. In December 2023, the company had sales of 704 crores and a net profit of 63 crores. By March 2024, sales increased significantly to 934 crores, with net profit rising to 78 crores, showing strong performance.

Here are the quarterly results for December 2023, March 2024, and June 2024:

(Figures in Rs. Crores)

|

Particulars |

Dec 2023 |

Mar 2024 |

Jun 2024 |

|

Sales |

704 |

934 |

626 |

|

Expenses |

606 |

819 |

547 |

|

Operating Profit |

98 |

116 |

79 |

|

OPM % |

14% |

12% |

13% |

|

Other Income |

4 |

9 |

11 |

|

Interest |

17 |

22 |

18 |

|

Depreciation |

2 |

2 |

2 |

|

Profit before Tax |

83 |

100 |

70 |

|

Tax % |

25% |

22% |

22% |

|

Net Profit |

63 |

78 |

55 |

|

EPS in Rs |

10.11 |

11.64 |

8.84 |

About Va Tech Wabag

Va Tech Wabag is a global company that focuses on water management solutions. Established over 90 years ago, it has become a leader in this field, operating in four continents. The company specializes in treating and managing water and wastewater for both cities and industries. With a strong commitment to innovation, Wabag has invested in research and development, with centers in Europe and India. They hold over 125 patents, showing their dedication to creating new technologies.

Wabag has successfully completed more than 6,500 projects worldwide, proving their ability to deliver quality work on time. Their main goal is to help communities and industries conserve, recycle, and reuse water, addressing important water challenges globally. By focusing on sustainability, Va Tech Wabag aims to make a positive impact on the environment and ensure that clean water is available for future generations.

Va Tech Wabag Q1 Results - FAQs

1. How has Va Tech Wabag performed in the last quarter?

Va Tech Wabag reported a total revenue of ₹626.50 crores for Q1.

2. What was Va Tech Wabag's net income for the last quarter?

Va Tech Wabag's net income for Q1 was ₹55.00 crores.

3. How does Va Tech Wabag's revenue compare to the previous year?

Va Tech Wabag's revenue increased by 13.33% compared to last year.

4. What challenges did Va Tech Wabag face in the recent quarter?

Va Tech Wabag experienced a 32.94% decline in revenue from the previous quarter.

5. What is the diluted EPS for Va Tech Wabag in Q1?

The diluted EPS for Va Tech Wabag in Q1 is 8.36.

6. How much did Va Tech Wabag spend on total expenses in Q1?

Va Tech Wabag's total expenses in Q1 were ₹5,651 million.

7. What was Va Tech Wabag's profit before tax in Q1?

Va Tech Wabag reported a profit before tax of ₹700 million for Q1.

8. How much did Va Tech Wabag earn from operations in Q1?

Va Tech Wabag earned ₹6,265 million from operations in Q1.

9. What is the market capitalization of Va Tech Wabag?

Va Tech Wabag has a market capitalization of ₹9,251 crores.

10. What was Va Tech Wabag's profit for the period in Q1?

Va Tech Wabag's profit for the period in Q1 was ₹548 million.