- Home »

- Quarterly Results »

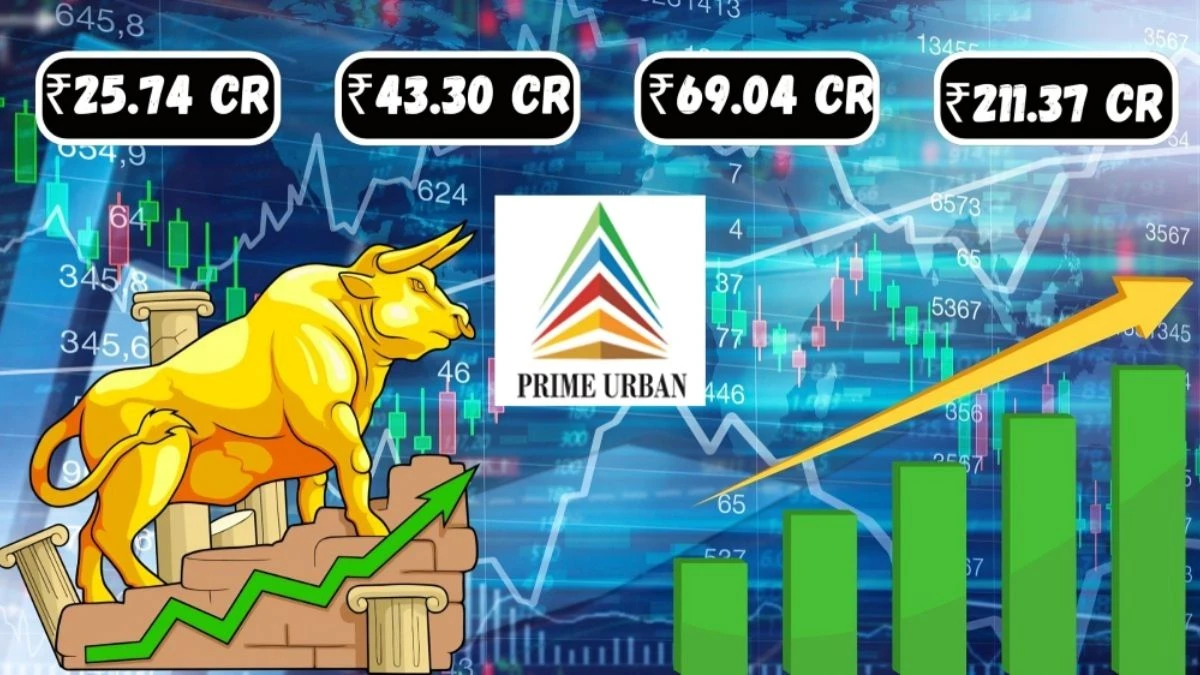

- Prime Urban Development India Q1 Results Total Income Drops to ₹25.74 Crore Net Loss of ₹43.30 Crore

Prime Urban Development India Q1 Results Total Income Drops to ₹25.74 Crore Net Loss of ₹43.30 Crore

Prime Urban Development India Q1 Results with a total income of ₹25.74 crore significantly lower than last year and expenses increased to ₹69.04 crore leading to a net loss of ₹43.30 crore.

by Ruksana

Updated Aug 16, 2024

Table of Content

Prime Urban Development India's Q1 results for the period ending June 30, 2024, the company reported a decrease in its total income. The revenue from operations was ₹375.00 crore, but when other income is included, the total income was only ₹25.74 crore, which is much lower compared to the previous year's total income of ₹475.17 crore.

Prime Urban Development India's expenses also increased, amounting to ₹69.04 crore for the quarter. This rise in expenses, combined with lower income, led to a loss before tax and exceptional items of ₹43.30 crore. This loss is less severe compared to the full-year loss of ₹211.37 crore reported for March 31, 2023.

Prime Urban Development India had no exceptional items to report and recorded a net loss after tax of ₹43.30 crore for the quarter. This loss reflects a challenging period for the company, although it is an improvement compared to the previous year's figures. The total comprehensive income for the quarter was also a loss of ₹43.30 crore. The earnings per share (EPS) were reported at ₹(0.16), which shows a slight improvement over last year.

Source: Here

For More Q1 Results check our Twitter Page

Prime Urban Development India Q1 Results

Prime Urban Development India table summarizes the key financial results for Q1:

|

Sr. No. |

Particulars |

30.06.2024 (Un-audited) |

|

1 |

Income from Operations |

375.00 |

|

a |

Revenue from Operations |

375.00 |

|

b |

Other Income |

25.74 |

|

Total Income |

25.74 |

|

|

2 |

Expenses |

|

|

a |

Cost of Land with Villa |

72.21 |

|

b |

Purchase of Stock in Trade |

5.37 |

|

c |

Changes in Inventories of Stock in Trade |

(5.37) |

|

d |

Employee Benefit Expenses |

12.38 |

|

e |

Finance Cost |

16.50 |

|

f |

Depreciation and Amortisation Expense |

4.50 |

|

g |

Other Expenses |

35.66 |

|

Total Expenses |

69.04 |

|

|

3 |

Profit/(Loss) Before Tax and Exceptional Items |

(43.30) |

|

5 |

Extraordinary Items |

(43.30) |

|

8 |

Tax for Prior Years |

(43.30) |

|

11 |

Total Comprehensive Income |

(43.30) |

|

12 |

Paid-Up Equity Share Capital (Face Value Rs.2 per Share) |

532.87 |

|

13 |

Reserves Excluding Revaluation Reserve |

(715.67) |

|

14 |

Earnings Per Share (Not Annualised) |

(0.16) |

Prime Urban Development India Financial Indicators

Prime Urban Development India has various key financial indicators. The company's market cap is ₹25.9 Crores, showing the total value of its shares. The current stock price is ₹9.72, with a high of ₹14.00 and a low of ₹7.00 over a certain period.

Here's the information in a table format:

|

Particulars |

Value |

|

Market Cap |

₹25.9 Crores |

|

Current Price |

₹9.72 |

|

High / Low |

₹14.00 / ₹7.00 |

|

Stock P/E |

Not Provided |

|

Book Value |

₹-1.41 |

|

Dividend Yield |

0.00% |

|

ROCE |

-19.4% |

|

ROE |

Not Provided |

|

Face Value |

₹2.00 |

Quarterly Results

Prime Urban Development India table shows the financial performance over three periods: December 2023, March 2024, and June 2024. Sales dropped significantly from Rs. 5.41 crore in December 2023 to just Rs. 0.14 crore in June 2024. Expenses also decreased, but not as sharply.

This table provides a snapshot of financial performance over three periods: December 2023, March 2024, and June 2024.

|

Metric |

Dec 2023 |

Mar 2024 |

Jun 2024 |

|

Sales (Rs. Cr) |

5.41 |

1.41 |

0.14 |

|

Expenses (Rs. Cr) |

5.84 |

1.75 |

0.45 |

|

Operating Profit (Rs. Cr) |

-0.43 |

-0.34 |

-0.31 |

|

OPM (%) |

-7.95% |

-24.11% |

-221.43% |

|

Other Income (Rs. Cr) |

0.11 |

0.10 |

0.10 |

|

Interest (Rs. Cr) |

0.19 |

0.17 |

0.19 |

|

Depreciation (Rs. Cr) |

0.05 |

0.08 |

0.05 |

|

Profit Before Tax (Rs. Cr) |

-0.56 |

-0.49 |

-0.45 |

|

Tax (%) |

-0.00% |

-0.00% |

-0.00% |

|

Net Profit (Rs. Cr) |

-0.57 |

-0.49 |

-0.45 |

|

EPS (Rs.) |

-0.21 |

-0.18 |

-0.17 |

About Prime Urban Development India

Prime Urban Development India, originally founded as Asher Textiles in 1936, has a long history of growth and transformation. The company began as a textile business, focusing on producing and trading textiles. In 1993, it was listed on the Bombay Stock Exchange and underwent a name change to ATL Textiles. This was followed by another rebranding to Prime Textiles in 2000. On July 5, 2010, the name was updated once again to Prime Urban Development India.

Prime Urban Development India has seen significant development over the decades. Under the leadership of the Patodia family, it expanded from trading to owning manufacturing plants. Starting in 1966 with a plant in Alwaye, Kerala, it grew to include additional facilities in cities like Hyderabad, Baroda, Palghat, and Tirupur. In the 1970s, it introduced Indian cotton yarn to European markets, establishing strong business relationships in countries like Italy and Spain.

Prime Urban Development India also made notable advances in Bangladesh during the 1980s, forming partnerships to supply garment machinery and training, eventually contributing to a major portion of Bangladesh's imports. In recent years, Prime Urban Development India has focused on modernizing its production to meet high international standards.

Prime Urban Development India Q1 Results - FAQ

1. What was Prime Urban Development India’s total income for Q1 2024?

Prime Urban Development India’s total income for Q1 2024 was ₹25.74 crore.

2. How did Prime Urban Development India’s Q1 2024 expenses compare to last year?

Prime Urban Development India’s Q1 2024 expenses increased to ₹69.04 crore.

3. What was the net loss for Prime Urban Development India in Q1 2024?

Prime Urban Development India reported a net loss of ₹43.30 crore for Q1 2024.

4. How did the earnings per share (EPS) change for Prime Urban Development India in Q1 2024?

Prime Urban Development India’s EPS for Q1 2024 was ₹(0.16), showing slight improvement.

5. Did Prime Urban Development India have any exceptional items in Q1 2024?

Prime Urban Development India had no exceptional items in Q1 2024.

6. What was Prime Urban Development India’s market cap as of Q1 2024?

Prime Urban Development India’s market cap was ₹25.9 crore.

7. What was the current stock price for Prime Urban Development India in Q1 2024?

The current stock price for Prime Urban Development India was ₹9.72.

8. What was the high and low stock price for Prime Urban Development India in Q1 2024?

Prime Urban Development India’s stock price ranged from ₹14.00 to ₹7.00.

9. What was Prime Urban Development India’s total comprehensive income for Q1 2024?

Prime Urban Development India’s total comprehensive income for Q1 2024 was a loss of ₹43.30 crore.

10. How did Prime Urban Development India’s sales in June 2024 compare to previous quarters?

Prime Urban Development India’s sales in June 2024 were ₹0.14 crore, down from previous quarters.