- Home »

- Quarterly Results »

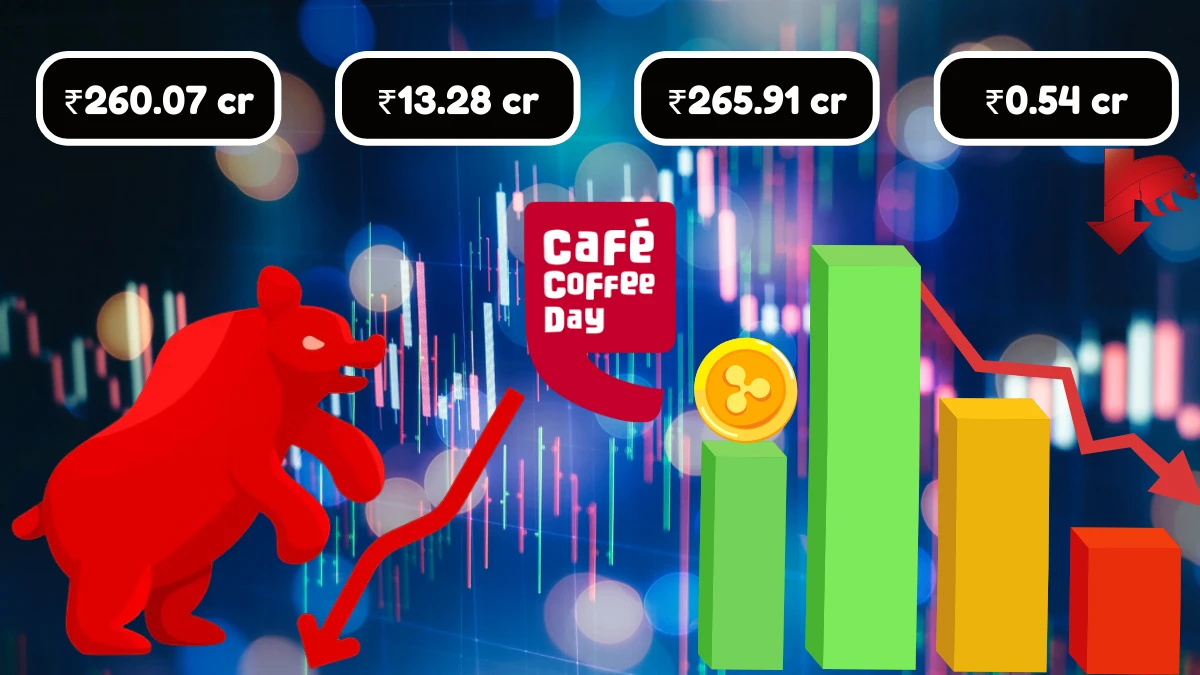

- Coffee Day Enterprises Q1 Results Revenue at ₹260.07 Crores with a Net Loss of ₹13.28 Crores

Coffee Day Enterprises Q1 Results Revenue at ₹260.07 Crores with a Net Loss of ₹13.28 Crores

Coffee Day Enterprises Q1 Results have been announced, showing a revenue of ₹260.07 crores and a net loss of ₹13.28 crores for the quarter ending June 30, 2024, as detailed in the Coffee Day Enterprises Q1 Results report.

by P Nandhini

Updated Aug 16, 2024

Table of Content

Coffee Day Enterprises Q1 Results 2024 - 2025

Here’s a summary of the key financial figures from Coffee Day Enterprises's Q1 results for the 2024-2025 fiscal year. The table highlights the company's revenue, expenses, and net profit/loss for the quarter ending June 30, 2024.

| Particulars | Q1 FY 2024-25 (June 30, 2024) | Q4 FY 2023-24 (March 31, 2024) | Q1 FY 2023-24 (June 30, 2023) |

|---|---|---|---|

| Revenue from Operations | ₹260.07 crores | ₹250.65 crores | ₹247.29 crores |

| Other Income | ₹5.84 crores | ₹7.04 crores | ₹16.68 crores |

| Total Income | ₹265.91 crores | ₹257.69 crores | ₹263.98 crores |

| Total Expenses | ₹278.08 crores | ₹252.72 crores | ₹239.93 crores |

| Profit/(Loss) Before Tax | ₹(11.88) crores | ₹(353.11) crores | ₹22.48 crores |

| Net Profit/(Loss) After Tax | ₹(13.28) crores | ₹(296.40) crores | ₹22.51 crores |

| Basic Earnings Per Share (EPS) | ₹(0.54) | ₹(14.33) | ₹0.97 |

Source: Click Here

For More Q1 results check our Twitter Page

Coffee Day Enterprises Q1 Results Overview

Coffee Day Enterprises, the parent company of Café Coffee Day, reported its financial results for the first quarter of the 2024-2025 fiscal year. The company's total income for the quarter ended June 30, 2024, was ₹265.91 crores, reflecting a slight increase from the previous quarter's ₹257.69 crores.

Revenue from operations stood at ₹260.07 crores, showing steady growth compared to the same period last year. However, despite the increase in revenue, the company posted a net loss of ₹13.28 crores, mainly due to higher expenses and financial costs.

The company continues to maintain a strong presence in the Indian market, with its subsidiary, Coffee Day Global, operating the largest chain of café outlets across more than 200 cities in the country.

Despite facing challenges, including rising costs, Coffee Day Enterprises remains focused on expanding its business and navigating the current economic environment. The board also reviewed the unaudited financial results of Coffee Day Global, ensuring transparency and continued commitment to its stakeholders.

Coffee Day Enterprises Current Market Overview

Coffee Day Enterprises is currently trading at ₹38.4 per share, reflecting a 4.52% increase. The company has a market capitalization of ₹811 crores. The stock has seen a high of ₹74.6 and a low of ₹33.3 over the year.

With a price-to-earnings (P/E) ratio of 6.21, the stock is relatively low-priced compared to its earnings. The company has a book value of ₹135, but it does not offer any dividends to its shareholders. Its return on capital employed (ROCE) is 2.87%, and the return on equity (ROE) is 5.64%, indicating modest profitability.

| Metric | Value |

|---|---|

| Current Price | ₹38.4 |

| Price Change | +4.52% |

| Market Capitalization | ₹811 crores |

| 52-Week High | ₹74.6 |

| 52-Week Low | ₹33.3 |

| Stock P/E Ratio | 6.21 |

| Book Value | ₹135 |

| Dividend Yield | 0.00% |

| Return on Capital Employed (ROCE) | 2.87% |

| Return on Equity (ROE) | 5.64% |

| Face Value | ₹10.0 |

Quarterly Results

Below is a summary of the quarterly financial results for Coffee Day Enterprises. for the periods ending in December 2023, March 2024, and June 2024. The table includes key metrics such as sales, expenses, operating profit, and net profit.

| Metrics | Dec 2023 | Mar 2024 | Jun 2024 |

|---|---|---|---|

| Sales (₹ Cr.) | 257 | 251 | 260 |

| Expenses (₹ Cr.) | 212 | 218 | 223 |

| Operating Profit (₹ Cr.) | 45 | 32 | 37 |

| Operating Profit Margin (OPM %) | 17% | 13% | 14% |

| Other Income (₹ Cr.) | 77 | -351 | 6 |

| Interest (₹ Cr.) | 16 | -7 | 21 |

| Depreciation (₹ Cr.) | 28 | 42 | 34 |

| Profit Before Tax (₹ Cr.) | 78 | -353 | -12 |

| Net Profit (₹ Cr.) | 76 | -296 | -13 |

| Earnings Per Share (EPS ₹) | 3.28 | -14.33 | -0.54 |

About Coffee Day Enterprises

Coffee Day Enterprises is the parent company of the popular Café Coffee Day (CCD) chain, which introduced the coffee culture in India with its first café in Bengaluru in 1996. The company has since grown to become one of the largest coffee chains in India, with outlets in over 200 cities.

Beyond its café business, Coffee Day Enterprises is involved in various sectors, including technology parks, logistics, financial services, and hospitality. The company also exports coffee to international markets like Europe and Japan, making it one of India's top coffee exporters.

Coffee Day Enterprises Q1 Results - FAQs

1. What is the total income reported by Coffee Day Enterprises for Q1 FY 2024-25?

Coffee Day Enterprises reported a total income of ₹265.91 crores for Q1 FY 2024-25.

2. How much revenue from operations did Coffee Day Enterprises earn in Q1 FY 2024-25?

Coffee Day Enterprises earned ₹260.07 crores in revenue from operations for Q1 FY 2024-25.

3. What was Coffee Day Enterprises' net profit or loss for Q1 FY 2024-25?

Coffee Day Enterprises posted a net loss of ₹13.28 crores for Q1 FY 2024-25.

4. How did Coffee Day Enterprises' total income in Q1 FY 2024-25 compare to Q4 FY 2023-24?

Coffee Day Enterprises' total income increased from ₹257.69 crores in Q4 FY 2023-24 to ₹265.91 crores in Q1 FY 2024-25.

5. What were Coffee Day Enterprises' total expenses for Q1 FY 2024-25?

Coffee Day Enterprises had total expenses of ₹278.08 crores for Q1 FY 2024-25.

6. What was Coffee Day Enterprises' profit or loss before tax for Q1 FY 2024-25?

Coffee Day Enterprises reported a loss before tax of ₹11.88 crores for Q1 FY 2024-25.

7. How does Coffee Day Enterprises' net loss in Q1 FY 2024-25 compare to Q4 FY 2023-24?

Coffee Day Enterprises' net loss decreased from ₹296.40 crores in Q4 FY 2023-24 to ₹13.28 crores in Q1 FY 2024-25.

8. What was the basic earnings per share (EPS) for Coffee Day Enterprises in Q1 FY 2024-25?

The basic EPS for Coffee Day Enterprises in Q1 FY 2024-25 was ₹(0.54).

9. What was Coffee Day Enterprises' other income in Q1 FY 2024-25?

Coffee Day Enterprises reported other income of ₹5.84 crores in Q1 FY 2024-25.

10. What was the operating profit margin (OPM) for Coffee Day Enterprises in Q1 FY 2024-25?

The operating profit margin (OPM) for Coffee Day Enterprises in Q1 FY 2024-25 was 14%.